Thank you to our Sponsors & Exhibitors

A Review of TSTF 2023 – More Greenfields, Please!

Access to the presentations is limited to TSTF 2023 attendees, please use the password which was provided by the [email protected]

One of the best comments coming out of the 11th Tax Stamp & Traceability Forum™ (TSTF), held from 2-4 October in Tbilisi, Georgia, was from a revenue authority attending the forum for the first time. They said that now that they’d seen first-hand what they’d been missing by not attending this event, they would be sure to attend all security printing conferences in future.

Another comment came from an exhibitor, who said it had been the best event in the Reconnaissance stable that he’d been to so far. When asked why that was, he replied: ‘lots of potential new customers’.

It’s true that there were plenty of revenue services registering this year, some of which we don’t often see at this event. These included Oman Tax Authority, General Tax Administration of Angola, State Revenue Committee of Armenia, Ministry of Finance Lebanon, Mongolian General Department of Taxation, Jordan Customs, and Ministry of Finance North Macedonia. All in all, 25 revenue and customs authorities registered for the event – a record number.

As far as total attendance was concerned, 213 registrants from 92 organisations in 45 countries signed up for TSTF 2023, representing 10% more people and almost 30% more countries than in 2022. In fact, this was one of the best forums in terms of attendance, which is a good indication that conferences are now back in full force.

Of particular importance for the sponsors of TSTF was the fact that several revenue authorities represented countries that hadn’t yet implemented tax stamps and track and trace – or that were looking to significantly upgrade and expand their existing programmes.

Having said this, some sponsors remarked that we could have done even better, by drawing more of the ‘greenfield’ countries to the conference – ie. those countries with nothing yet implemented.

This is why, going forward, Reconnaissance, with the support of the International Tax Stamp Association (ITSA), will implement a dedicated campaign to increase attendance by these key target countries at the next TSTF.

Another point that came across during the different discussions was that we should introduce a meeting for revenue and customs authorities only, as a platform for them to exchange experiences and ideas without suppliers being present. The aim of this is to make such exchanges freer and less guarded, and we will therefore be looking to incorporate this type of meeting in the next TSTF.

Key themes

A number of key themes emerged from the presentations, panel discussion, and workshops at the conference.

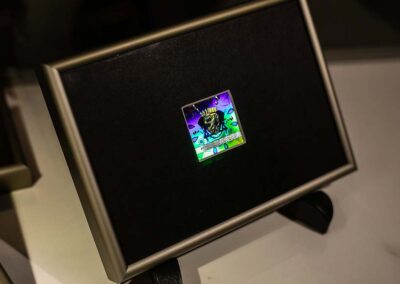

One key theme was the review of the tax stamp ISO standard 22382, which had its own pre-conference workshop. Ian Lancaster, Project Leader for the ISO review led the workshop, with the intention of gathering attendees’ views and ideas on what should be changed, taken out of, or added to the standard. One suggestion was that 22382 should include more recommendations related to track and trace systems, given that such systems are increasingly associated with tax stamp programmes.

Another theme that was extensively discussed was the implementation of the track and trace system and global information sharing point mandated under the WHO FCTC Protocol to Eliminate Illicit Trade in Tobacco Products. There are currently 68 parties to the Protocol and most of them should have implemented track and trace by September 2023 – which is unfortunately not the case, as Luk Joossens from Smoke Free Partnership pointed out in his presentation on the global status of implementation of the Protocol.

Still on the subject of the Protocol, ITSA held a pre-conference seminar for revenue authorities and ITSA members, where it used two real-case examples to demonstrate how countries with tax stamp programmes already in place could use these programmes to exchange track and trace data in line with Protocol requirements. One key point raised during the seminar, by Luk Joossens, was that not enough countries were extending their tax stamp programmes to include export products, with the result that these unmarked, unmonitored products could be easily diverted to illicit channels.

A third key topic looked at what really happens in the field in terms of tax stamp inspection. Francisco Mandiola of FMA Secure was joined by Ghana, Mauritius and Panama revenue authorities to talk about their countries’ on-the-ground experiences.

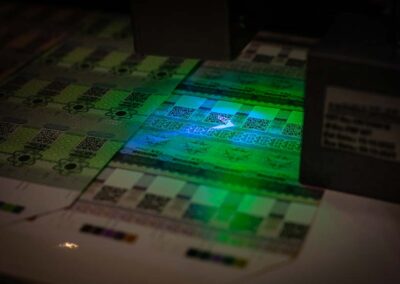

High on the agenda as well was the use of direct marking programmes on beverages. Apart from presentations by SICPA and Optel Group, revenue authorities were treated to a tour of a nearby brewery where they could see direct fiscal marking on beverages in action.

Finally, the conference covered a wide range of country case studies, including recreational cannabis legalisation in Canada, Lebanon’s new tobacco authentication and traceability programme, insights from implementing tax stamps across the countries of the Gulf Cooperation Council, and the extensive system used by our hosts, Georgia Revenue Service.

Moving to the next TSTF, we are pleased to announce that this will take place in early 2025 in Cape Town, South Africa, marking the second time TSTF has been held on the African continent. South Africa is a vast country with currently no tax stamp or track and trace system in place… on anything. So, a prime ‘greenfield’ if ever there was one.

Hungarian Banknote

Optel Group

Rwanda Revenue Authority

Gallery

Click on any picture to see the full gallery.

Portuguese Mint – Imprensa Nacional Casa da Moeda

Botswana Revenue Authority

De la Rue

Attendees

Advanced Track & Trace (ATT)

France

Alitheon

USA

APO Production Unit

Philippines

Authentix Inc

USA

Baldwin Vision Systems

USA

Banknote Corporation of America

USA

Canadian Bank Note Company Ltd

Canada

Cartor Security Printers

France

Casa da Moeda do Brazil

Brazil

D&H Sahar Security Printing

India

De La Rue

United Kingdom

Demax Holograms

Bulgaria

Digimarc

USA

Estonian Tax and Customs Board

Estonia

Excise Department of Sri Lanka

Sri Lanka

FCTC Implementation and Monitoring Center

Georgia

Federal Board of Revenue – Pakistan

Pakistan

FMA Secure

Chile

Garsų Pasaulis UAB

Lithuania

General Directorate of Customs

Albania

General Directorate of Revenue

Panama

General Tax Administration

Angola

Ghana Revenue Authority

Ghana

Government of India

India

Green Graphics Trading DMCC

Dubai

GWT Wasser- und Wärmetechnik GmbH

Austria

Hicof AG

Switzerland

HP Indigo Secure

USA

Hungarian Banknote Printing Company

Hungary

Imprensa Nacional

Angola

Industrial Inkjet

United Kingdom

Inexto SA

Switzerland

International Tax Stamp Association

UK

Japan Tobacco International SA

Switzerland

JCIC International

UK

Jordan Customs

Jordan

Jura JSP

Hungary

Kenya Revenue Authority

Kenya

Lake Image Systems

UK

Leonhard Kurz Stiftung & Co KG

Germany

Linxens

Germany

Luminescence Sun Chemical Security

UK

Madras Security Printers

India

Matrix Systems

Uzbekistan

Mauritius Revenue Authority

Mauritius

Ministry for Finance and Employment

Malta

Ministry of Finance

Lebanon

Ministry of Finance Republic of Poland

Poland

Ministry of Railways

Bangladesh

Mongolian General Department of Taxation

Mongolia

MTDHouse

Angola

National Tax and Customs Administration of Hungary (NTCA)

Hungary

Oman Tax Authority

Oman

OpSec Security

UK

OPTEL Group (Ireland)

Ireland

Pakistan Revenue Authority

Pakistan

POLAR-Mohr

Germany

Polish Security Printing Works (PWPW)

Poland

Proza Holdings

Israel

Quantum Base

UK

RBC TUR

Brazil

Reemtsma Cig.fabriken / Imperial Brands

Germany

Republic of North Macedonia, Ministry of Finance, Customs Administration

North Macedonia

Revenue Service Georgia

Georgia

Rogell Advisory Services

RSE Banknote Factory of the National Bank of the Republic of Kazakhstan

Kazakhstan

Rwanda Revenue Authority

Rwanda

Schwarz Druck GmbH

Germany

SCOPSIS

Lebanon

Security Printing and Minting Corporation India Limited

India

SICPA SA

Switzerland

Smoke Free Partnership

Belgium

Smurfit Kappa Security Concepts

Ireland

Sri Lanka Customs

Sri Lanka

Stardust Secured

USA

State Revenue Committee

Armenia

State Tax Service

Azerbaijan

Tanzania Revenue Authority

Tanzania

The Indonesian Government Security Printing and Minting Corporation

Indonesia

THYMARIS

Switzerland

TT Technologies

Azerbaijan

Uganda Revenue Authority

Uganda

United Security Printing

United Arab Emirates

University of Illinois Chicago

USA

World Health Organization Country Office Georgia

Georgia

Worldline

France

Zeiser

Germany

Kenya Revenue Authority

Manipal Technologies

Sri Lanka Customs

Programme

Sunday 1 October 2023

18:30 Welcome Reception – sponsored by Georgia Revenue Service

Access to the presentations is limited to TSTF 2023 attendees, please use the password which was provided by the [email protected]

Monday 2 October 2023

09:00 – 10:30 What’s Next for the International Tax Stamp Standard?

Admission is free for revenue authorities, other government agencies, and ITSA members. All other attendees are subject to a fee of €350.

In 2018 the International Standards Organisation (ISO) published ISO 22382, ‘Guidelines for the content, security, issuance and examination of excise tax stamps’. This standard is primarily intended as guidance for tax stamp issuers – including specifiers and designers – but it has proven useful to suppliers in facilitating their discussions with customers. Some revenue agencies have already referred to ISO 22382 in their requests for proposals.

It is ISO procedure to review a standard every five years, so this standard is now due for review.

The review is the opportunity to update and improve the standard based on the experience of its first years since publication and to incorporate new developments. The International Tax Stamp Association (ITSA), which contributed to the development of the standard, has launched a preliminary consultation with stakeholders to learn their view of the standard and – more importantly – how it should be improved through this review.

The Project Leader for this review is Ian Lancaster, who will therefore lead this workshop. He will present a draft of the proposed changes so that you – if you attend this workshop – can give your views and ideas on what should be changed, taken out of, or added to the standard.

This will also be your chance to consider not only how to improve this guidance standard, but whether there should be a corollary compliance standard for tax stamp suppliers, ie. so that suppliers can be certified as meeting the requirements of that standard, making it easier for customers to know that their chosen supplier is indeed suitable as a security stamp supplier.

All stakeholders in the tax stamp environment – revenue agencies, tax stamp issuers, stamp producers and suppliers, component producers and tax stamp inspectors – should have their say, so come to this workshop to contribute and hear others’ views on the next version of this important international standard.

10:30 Break – Refreshments

11:00 – 12:00 Implementing the FCTC Protocol

Admission reserved for revenue authorities, other government agencies, and ITSA members only. No other delegates will have access to this session.

Join ITSA for a discussion on how existing tax stamp programmes can technically comply with, and participate in, the global tobacco track and trace regime and information-sharing focal point (GSP) required under the WHO FCTC Protocol to Eliminate Illicit Trade in Tobacco Products.

ITSA will present a real-case example of two countries with tax stamp programmes already in place, to demonstrate how they can use their programmes to exchange track and trace data in line with Protocol requirements.

Therefore, most countries in the world are concerned by this game-changing treaty.

Time permitting, we will also provide ITSA members with an introduction and status update on the European Union’s Digital Product Passport initiative.

Government authorities and ITSA members who have already registered for the tax stamp standard workshop will be automatically registered for the ITSA session. Those not yet registered, who wish to attend the ITSA session, are invited to contact Alison Bell ([email protected]).

13:30 – 17:00 Tour of Zedazeni Brewery

We are very privileged to offer government delegates the chance to visit the Zedazeni brewery in Tbilisi on the afternoon of Monday 2nd October 2023. The visit will give government attendees the opportunity to see a direct marking project in operation. The Georgia Revenue Service will be in attendance and provide an overview of the overall fiscal marking programme as an introduction to the visit.

18:30 Opening Reception – sponsored by Madras Security Printers

Tuesday 3 October 2023

Hover on the presentation title or speaker to see if more information is available.

Session 1 – Welcome and Overview

09:05

Welcome Address

Levan Dgebuadze

Georgia Revenue Service

09:30

The Importance of Analysis – Before and After Track and Trace Implementation

Nicola Sudan

International Tax Stamp Association (UK)

09:45

Status of Track and Trace System Required Under WHO FCTC Protocol

Luk Joossens

Smoke Free Partnership

10:00

An Environmental Scan: Current Developments Impacting Tax and Customs Administrations, and How to Leverage Them to your Advantage

Telita Snyckers

International Tax and Customs Transformation Consultant

10:15 Session Q&A

10:30 Break – Refreshments

Session 2 – Country Cases part I

11:00

Impact of Tax Stamps on Ghana’s Excise Tax Revenue

Michael Gyasi

Ghana Revenue Authority (Ghana)

11:15

Protection from the Storm: Implementing Lebanon’s Authentication and Traceability Solution

Mohamad Ali Ahmad

VP Government Solutions SCOPSIS (OpSec) (UK)

11:30

How Panama is Addressing Illicit Trade

Milagro Mendoza

General Directorate of Revenue (Panama)

11:45

Successful Tax Stamp Programmes are Easy, So Why do So Many Fail?

Tim Driscoll

Authentix (USA)

12:00 Session Q&A

12:15 Lunch

13:45 Session 3 – Panel Discussion – How do Inspectors Really Authenticate Tax Stamps?

Francisco Mandiola – FMA Secure – Chile – Chair

With panellists from tax and customs authorities

The panel discusses what actually happens in the field in terms of customs and law enforcement inspection techniques. It will talk about what devices and features are really used by inspectors to identify and authenticate tax stamps and products.

Are smartphones used as much as we think they are to scan barcodes on tax stamps or detect security features, or do inspectors rather rely on proprietary readers? And do inspectors ever use optical features such as holograms to authenticate tax stamps and products? Or maybe they don’t use any of these techniques and all, and rather rely on other methods to weed out acts of non-compliance and illicit trade?

14:45 Break – Refreshments

Session 4 – Direct Marking / Serialisation

15:30

Beverage Tax Stamps with Secure Direct Marking: Benefits Across a Dozen Countries

Ruggero Milanese

SICPA (Switzerland)

16:00

The Power of Digital Security Printing: Using Design / Personalisation Combinations to Solve Authentication Challenges

Tadej Turk

JURA (Hungary)

16:15

International Regulatory Aspects of Track and Trace & Related Issues

Jeannie Cameron

JCIC International

16:30 Session Q&A

16:45 Extended Exhibition Viewing

18:00 Gala Dinner – sponsored by De La Rue

Wednesday 4 October 2023

Session 5 – Country Cases part II

09:00

Recreational Cannabis Legalisation: The Canadian Experience

Tim McIntyre

Canadian Bank Note Company (Canada)

09:30

Insights and learnings from Digital Tax Stamp solutions in the Gulf Cooperation Council

Dave Sharratt

De La Rue (UK )

09:45

Encounters with Counterfeits of Digital Security Features

Sergej Toedtli

Thymaris (Switzerland)

10:00 Session Q&A

10:15 Break – Refreshments

Session 6 – Innovations

11:00

Optical Q-ID® – Unbreakable Quantum Signatures Verified by Standard Smartphone

Prof. Robert Young

Quantum Base (UK)

11:30

So Many Features, So Little Space – A Novel Look at Multifunctional Security Features

Stefaan D'hoore

Luminescence Sun Chemical Security (UK)

11:45

Who Cares About the Brakes on a Ferrari? Why Prioritizing Quality Control in Your Production Line will Help You Down the Line

Erwin Wagner

Baldwin Vision Systems (USA)

12:00 Session Q&A

12:15 Lunch

Session 7 – Digital and Physical Security

13:45

How to protect citizens while scanning 2D barcodes?

Zbigniew Sagan

Advanced Track & Trace (France)

Vincent Leyris

Advanced Track & Trace (France )

14:00

Nano-Optical Elements for Physical Security of Tax Stamps

Valentin Monovski

Demax Holograms (Bulgaria)

14:15

The Future of the International Standard for Tax Stamps

Ian Lancaster

Lancaster Consulting and Reconnaissance International (UK)

14:30

The Role of Smartphones in the Authentication Space – A New Report

Chander Shekhar Jeena

Reconnaissance International (UK)

14:45 Session Q&A

15:00 Closing Remarks and Farewell Drinks

Sponsors

Thank you to our 2023 Sponsors and Exhibitors

Many thanks to the following sponsors and exhibitors for taking part in our wonderful exhibition running alongside the conference:

Platinum – Madras Security Printers

Gold – Authentix, De La Rue, Jura JSP – HP Indigo Secure, SICPA, United Security Printing

Silver – Alitheon, Baldwin, Demax Holograms, KURZ, Luminescence Sun Chemical Security, OpSec Security

Exhibitors – Advanced Track & Trace (ATT), Industrial Inkjet Ltd, INEXTO SA, Interantional Tax Stamp Association(ITSA), Lake Image Sytems, POLAR-Mohr, Schwarz Druck GMBH, Stardust Secured, Thymaris